box 16 - state distribution Box 16 shows the state tax withheld from your distribution. You may need to report this amount on your state tax return, depending on your situation. See the form instructions for more details . 'Dark green is a perennially sophisticated shade that complements a dark Tudor oak. Try pairing deep green cabinets with an oak island, herringbone flooring, and shiny brass hardware. Fresh white worktops and a matching slab splashback will help keep the space open and airy,' suggests Tom. 4. Opt for a timeless cabinet stylePure White (sw 7005) works its magic by perfectly balancing the cozy warmth of oak cabinets with the cool, modern vibe of stainless steel appliances. The outcome is a super inviting space where you’ll enjoy cooking .

0 · taxable amount not determined

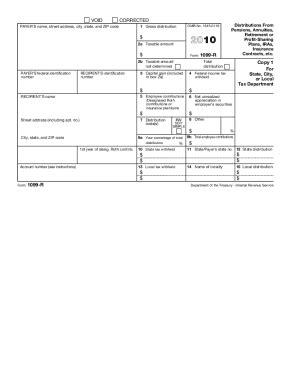

1 · irs form for pension income

2 · form 1099 r box 2a

3 · 1099 r taxable amount

4 · 1099 r is for what

5 · 1099 r boxes explained

6 · 1099 r box 8

7 · 1099 r box 16 blank

Aug 1, 2021 - Explore Shawna's board "White House Copper Roof" on Pinterest. See more ideas about copper roof, house exterior, house styles.

If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State .

In boxes 16 and 19, you may enter the amount of the state or local distribution. Copy 1 may be used to provide information to the state or local tax department. Copy 2 may be used as the .Box 16 shows the state tax withheld from your distribution. You may need to report this amount on your state tax return, depending on your situation. See the form instructions for more details .

The payer populates their state identification number here (you should have a value here if you have an amount in Box 14 on your 1099-R). Box 16. This box shows the .

His 1099-R shows a taxable distribution in box 1 and 2 for fed taxes. However, box 16 (state distribution) does not show an amount. Does that mean this pension/retirement . Box 1: Gross distribution. You should find the total amount of pension benefits or account distribution in Box 1, before tax withholdings. This amount should include the following: Direct rollovers to or from an individual . This box identifies the distribution code and tells the IRS the type of distribution taken by the taxpayer. The type of distribution matters because it helps to identify whether the money from the distribution is taxable or non . You should enter the full amount as the state distribution in box 16 when entering your Form 1099-R since you do have state withholding. Use the federal taxable amount for .

If your Form 1099-R does not have an amount in box 16 for a state distribution, but there is an amount in box 14 for state tax withheld, then the review message thinks there should be something in box 16. If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State .

In boxes 16 and 19, you may enter the amount of the state or local distribution. Copy 1 may be used to provide information to the state or local tax department. Copy 2 may be used as the recipient's copy in filing a state or local income tax return.

taxable amount not determined

irs form for pension income

branded stainless steel lunch box

For distributions from a Roth IRA, generally the payer isn’t required to compute the taxable amount. You must compute any taxable amount on Form 8606. An amount shown in box 2a may be taxable earnings on an excess contribution. Loans treated as distributions. The payer populates their state identification number here (you should have a value here if you have an amount in Box 14 on your 1099-R). Box 16. This box shows the amount of your state distribution (you should have a value in .Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding.

If Minnesota state income tax was withheld from your benefit payments, this box shows the amount submitted to the Minnesota Department of Revenue to cover your Minnesota tax liability. Include the amount on your Minnesota income tax return as tax withheld. You must file Form 1099-R with the IRS if you have given away or are treated as having made a distribution of or more from any of the following: Pensions. Annuities. Charitable gift annuities. Survivor income benefit plans. Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Since retirement income follows residency, you'll need to apply the law for the client's state of residency. And you'll have to determine if it qualifies as a disability retirement by asking your client some questions about their circumstances.

Box 16 reveals the state distribution on the 1099-R, while Box 14 indicates the state tax amount withheld. Important to note is that it is the taxpayer's, or preparer's, responsibility to determine the taxable amount for the year's total distribution.If your Form 1099-R does not have an amount in box 16 for a state distribution, but there is an amount in box 14 for state tax withheld, then the review message thinks there should be something in box 16.

If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State .

In boxes 16 and 19, you may enter the amount of the state or local distribution. Copy 1 may be used to provide information to the state or local tax department. Copy 2 may be used as the recipient's copy in filing a state or local income tax return.For distributions from a Roth IRA, generally the payer isn’t required to compute the taxable amount. You must compute any taxable amount on Form 8606. An amount shown in box 2a may be taxable earnings on an excess contribution. Loans treated as distributions. The payer populates their state identification number here (you should have a value here if you have an amount in Box 14 on your 1099-R). Box 16. This box shows the amount of your state distribution (you should have a value in .

Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding.If Minnesota state income tax was withheld from your benefit payments, this box shows the amount submitted to the Minnesota Department of Revenue to cover your Minnesota tax liability. Include the amount on your Minnesota income tax return as tax withheld. You must file Form 1099-R with the IRS if you have given away or are treated as having made a distribution of or more from any of the following: Pensions. Annuities. Charitable gift annuities. Survivor income benefit plans. Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Since retirement income follows residency, you'll need to apply the law for the client's state of residency. And you'll have to determine if it qualifies as a disability retirement by asking your client some questions about their circumstances.

brass cnc machining quotes

form 1099 r box 2a

What inventor template creates a standard sheet metal part file? There is a circle in the middle constraint, what was used? When you create a drawing view of a presentation file as shown, what options should you select to show the lines between parts? When you want to constraint an object on top of another ?

box 16 - state distribution|1099 r box 8