metal fabrication business valuation Company A could expect a valuation of between $600,000 and $900,000 (equivalent multiplier of between 2 and 3), while company B could expect a valuation between . $44.00

0 · valuation multiples iron and steel

1 · metal manufacturing market

2 · metal manufacturing industry

3 · metal fabrication market size

4 · metal fabrication industry

5 · fabricated metals m&a

6 · fabricated metal products valuation

7 · fabricated metal products trends

$250.00

The Fabricated Metal Products Manufacturing Industry is comprised of multiple sub-industries, from Structural Metal Product Manufacturing to Ball Bearing Manufacturing. The 15 sub-industries have a total market size of 0Bn and a compound annual growth rate (CAGR) of 2.3% for .The metal fabrication market in the U.S. was valued at US$ 362.4 Bn in 2020 and is expected to cross US$ 473.7 Bn by 2031. In terms of raw material, the iron & steel segment constituted .

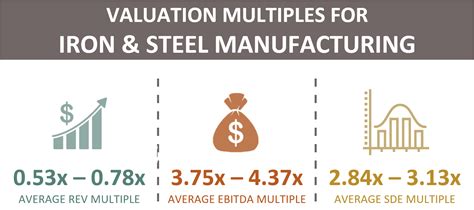

When valuing an iron and steel manufacturing business, the valuation expert determines what multiples for iron & steel manufacturing are most applicable. Using several valuation methods, they will determine a fair . Company A could expect a valuation of between 0,000 and 0,000 (equivalent multiplier of between 2 and 3), while company B could expect a valuation between . The valuation equates to a 7.9x-8.5x multiple of projected 2020-adjusted EBITDA. “Adding TerraSmart .to our existing solar business significantly increases our presence in the .For example, the Business Reference Guide expects offers to fall within these ranges: 75% to 85% of gross sales plus inventory; 5 to 6 times EBIT; 4 to 6 times EBITA; 4 to 6 SDE plus inventory; Once the transaction progresses, lenders will ultimately ask for a professional valuation of the metal fabrication shop.

Those fabricators with the right mix of customers, along with the processes and technologies in place to deliver and scale up reliably, could see significant growth going into 2024. Their performance shows the traditional .

The metal fabrication industry practice group provides merger and acquisition transactions advisory services to assist executives meeting their goals. Search. Search. . Business Services Chemicals/Plastics Commercial Real Estate Consumer Retail .

Download and fill out this spreadsheet for a you to obtain a basic valuation of your company's equity. . but the multiples for steel fabrication business are some of the lowest multiples to be . For instance, the revenue of a metalworking manufacturing business is ,000,000. In this valuation, the business appraiser determines a 0.62x REV multiple is applicable. As a result, the approximate value of the metalworking machinery manufacturing business is ,240,000. ,000,000 X 0.62x = ,240,000 Manufacturing company valuations also varied substantially based on the seller’s representation or lack thereof; companies that opted to run their own M&A process earned, on average, 31% less from their deal than companies that ran the same process through an M&A advisory firm or investment bank. . Buyers want to know how capital intensive .

Metal Fabrication Market The global metal fabrication market was valued at ,569 million in 2020, and it is projected to grow at a CAGR of 3.5% from 2021 to 2031 as per research published by Facts and Figures.Biz. Metal fabrication companies may confront a variety of obstacles if the COVID-19 crisis persists for a long period.We have experience selling Metal Fabrication companies and have potential buyers that want to purchase additional metal manufacturing companies and metal products distribution companies. Synergy Business Brokers has been selling manufacturing and distribution companies since 2002, and we have a potential buyer database of 30,000, many of which .

Petroleum, automobiles, construction and so many other types of businesses rely heavily on the metal fabrication trade but at the same time, the stability of these industries affect metal manufacturing. Metal Fabrication started 2015 with high profitability and steady growth and while it has slowed slightly, the industry is still on track. If .

EBITDA multiples are one of the most commonly used business valuation indicators that is often used by investors or potential buyers to assess a company’s financial performance. The EBITDA multiple will depend on the size of the subject company, its profitability, its growth prospects, and the industry in which it works.Specialty Metal Fab & Powder Coat Shop-Tools & Equipment Included. Established in 2005, this metal fabrication and powder coating business serves local, national, and international clients. With a. More details » Financials:

Business Opportunity: An opportunity exists to purchase the business and assets of a metal fabrication business operating in the North of England. The business has a an established heritage which includes a wide range of bespoke fabrication design, testing and manufacturing projects for a diverse client base.Spokane County, WA:The established company, is a manufacturing, designing, fabrication, and repair establishment that specializes in custom turn-key conveyor systems. They provide products and services that include a wide range of conveyors and their components, sorting and separation equipment, structural components, replacement parts, installation of new equipment, repair .

Metal Fabrication Industry in India Size & Share Analysis - Growth Trends & Forecasts (2024 - 2029) The Metal Fabrication Industry Report in India is Segmented by Material Type (Steel, Aluminum, and Others), End-User . A seller wants to improve the business to drive higher EBITDA (earnings before interest, taxes, depreciation, and amortization) multiples. EBITDA indicates the profitability of a company and is considered when .

valuation multiples iron and steel

Metal fabrication market in the U.S. is broadly affected by several factors, including expansion of the construction sector and ongoing investments in the energy & power industry in the country . The U.S. metal fabrication market is expected to surpass valuation of US$ 473.7 Bn by 2031. However, the need to competitive intelligence and reduce . Many business owners don't understand how a metal fabricating asset valuation works, which causes them to wait until specific circumstances to have one performed. However, by understanding how the process works, you can get a better grip on how to use this valuable tool to help manage your business' metal fabrication equipment assets. The business is well established and provides a metal fabrication capabilities for a range of applications. The purchase will be executed at the earliest opportunity. All interested parties will be requested to sign a non-disclosure agreement and specifically deal with Middleton Barton Asset Valuation Limited as appointed agent on behalf of the . A perfect storm has gathered over the custom metal fabrication business for years. So many are nearing retirement and looking for an exit strategy. Younger generations—many of whom came of age when globalization really ramped up in the 1990s and early 2000s—aren’t interested in buying, so outside investors like private equity (PE) are .

The current valuation of Edvan Industries (Metal Grating Fabrication & Distribution Business) is 00.000. What is Edvan Industries (Metal Grating Fabrication & Distribution Business)’s current revenue?Valuation Services; Asset & Business Sales; Corporate Recovery Services; Secured Lending Valuations; Oil and Gas; Plant & Machinery; Real Estate; About Us; Contact; Sheet Metal Fabrication Machinery & Conventional Engineering Machine Tools. Sale type Category Viewing Location; Online Auction: Engineering:Get insights into manufacturing business valuation metrics, learn how to market to the right buyers, and sell your business successfully. Businesses Franchises Brokers. Buy a Business. . Metal Products 2.78 0.75 Paper and Printing 2.45 0.53 Rubber and Plastic 4.04 1.14 Sign Manufacturers 2.79 0.66 .Manufacturing: Report: Auto, Boat and Aircraft Manufacturers: 0.71 3.25 . Metal Product Manufacturers: 0.73 3.06 Packaging Businesses: 0.76 3.18 . Business valuation multiples are used to benchmark the value of a business on the open market. By comparing a business for sale to other, similar businesses that recently sold in the same market .

San Diego, CA:For Sale: Established sheet metal fabrication business specializing in manufacturing vintage car replacement parts. Key Features: • Niche mail-order business with unlimited growth potential • Has major nationwide retail distributor • Local custom work includes Del Mar Racetrack, US Navy, San Diego Zoo, and more • 2 employees include 1 master .India Metal Fabrication - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) ABOUT US; . Sheet Metal Fabrication Services - Global Strategic Business Report Report ; 597 Pages ; November 2024; Global. From. Sheet Metal Fabrication Services Market by Form, Material, Service Type, Production, End User - Global . Ornamental and Architectural Metal Manufacturing Business Reference Guide Online January 23, 2024. Access the Full Article. . Business Valuation Resources 111 SW Columbia St, Suite 750 Portland, OR 97201. Phone: 1-503-479-8200 Fax: 1-503-291-7955. Email: [email protected]

what's a junction box look like

when to use cooling fans electrical enclosure

$450.00

metal fabrication business valuation|valuation multiples iron and steel