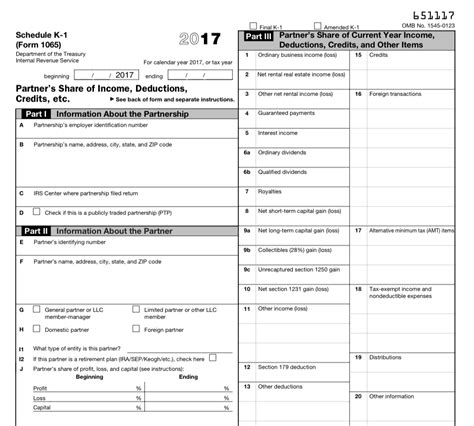

k-1 box 19 distributions a Here is more detail of what the code means for box 19 on the K-1. Code A. Cash and . Plastic junction boxes are used primarily with plastic-sheathed cable (also called .

0 · statement a schedule k 1

1 · schedule k 1 taxes

2 · schedule k 1 dividends

3 · k 1 other information codes

4 · k 1 non deductible expenses

5 · k 1 loss limitations

6 · k 1 line 19a

7 · how is k1 income taxed

In this comprehensive guide, we explore 20 different types of hammers, examining their materials, common uses, and significance in different fields. Whether it’s carpentry, metalworking, masonry, or specialized crafts like blacksmithing and stonemasonry, there’s a hammer tailored to every job.

Here is more detail of what the code means for box 19 on the K-1. Code A. Cash and marketable securities. Code A shows the distributions the partnership made to you of cash and certain marketable securities. Code B. Distribution subject to section 737.Here is more detail of what the code means for box 19 on the K-1. Code A. Cash and .TurboTax is here to make the tax filing process as easy as possible. We're .From simple to complex taxes, filing is easy with America’s #1 tax prep provider. Get .

statement a schedule k 1

schedule k 1 taxes

We would like to show you a description here but the site won’t allow us.Box 19. Distributions. For 2023, partners receiving distributions of property from a partnership in a liquidating or non-liquidating distribution under certain circumstances must attach a statement . Schedule K-1 for partnerships reports distributions to the partners in box 19A. Since you have to report your share of the partnership income or loss for the tax year whether or not .

This article will help you enter a Schedule K-1 distribution for box 19, A on a partnership or fiduciary return in Lacerte.

Purpose of Schedule K-1 The partnership uses Schedule K-1 to report your share of the partnership's income, deductions, credits, etc. Keep it for your records. Do not file it with your .The Form 1065 Schedule K-1 shows two types of distributions on line 19. One distribution is shown in the amount of ,000 with the letter “A” in front of it. The second distribution is in the amount of ,000 and has the letter “C” in front of it.Box 19. Distributions Report any distributions you received in the form of cash, marketable securities, or property, or any distributions subject to section 737 here.

metal 1900 box brace

schedule k 1 dividends

metal 3 4 inch flagpole bracket

Schedule K-1 on your tax return. Your share of S corporation income isn't self-employment income and it isn't subject to self-employment tax. The amount of loss and deduction you may . The partnership will determine the gain, report the gain on the partnership return and the K-1's. Keep in mind that some of the gain may need to be reported as unrecaptured section 1250 gain. The distribution is just . This article will help you enter a Schedule K-1 distribution for box 19, A on a partnership or fiduciary return. For more Schedule K-1 resources, check out our Tax topics . Answered: Where do I input Box 19 information from Passthrough K1s? The tab says Llines 12 - 19, but that's a lie because it stops at Box 18. Where. . Your partnership received a distribution from another partnership; the K-1 you provide your partners should only reflect the distributions they received from you.

Box 19. Distributions. For 2023, partners receiving distributions of property from a partnership in a liquidating or non-liquidating distribution under certain circumstances must attach a statement to their tax return. See Box 19. Distributions, later. Box 20. Other information. Code AH, Other information, previously included a number of .

Schedule K-1 (Form 1065) only info is Box 19 Hi - my husband was given equity in his company (LLC) when he was hired in 2014. He received a distribution in 2019 and was issued a K-1, Form 1065. The only information populated in Part III is Box 19: A - Cash and Marketable Securities. When I enter this information in Turbo Tax, my Tax refund .This article focuses solely on the entry of the Tax Exempt Income, Non-Deductible Expenses, Distributions and Other Information.Learn more. These items are found on Box 18, Box 19 and Box 20 of the Schedule K-1 (Form 1065) Partner's Share of Income, Deductions, Credits, etc.Box 19. Distributions. For 2023, partners receiving distributions of property from a partnership in a liquidating or non-liquidating distribution under certain circumstances must attach a statement to their tax return. See Box 19. Distributions, later. Box 20. Other information. Code AH, Other information, previously included a number of .

Box 19 of the K-1 (1065) records distributions made to you, the partner or member, during the year. The distributions could have been cash or in other types of property. Think of a distribution as being similar to a dividend as they are a reduction of capital/equity in the business.K-1 Earnings; Schedule K-1 Form 1065; Credit and Other Information; This section of the program contains information for Part III of Schedule K-1 1065. Please be aware that the program does not allow for direct entries for all Box 14-20 information. You can review this article for any Box 20 codes that are not included in the Schedule K-1 entry. I attended your Manager Briefing – Clearing up K-1 Confusion (access the video here). I have a question regarding a recent K-1 I received. From the 1065 K-1: Item L Withdrawals and Distributions was ,000. On the same K-1, Box 19 A was ,500. There were no other codes listed in box 19 and full business tax returns were not provided.

k 1 other information codes

Box 19. Distributions...25 Box 20. Other Information...26 List of Codes...32 Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Schedule K .

Box 19. Distributions. For 2023, partners receiving distributions of property from a partnership in a liquidating or non-liquidating distribution under certain circumstances must attach a statement to their tax return. See Box 19. Distributions, later. Box 20. Other information. Code AH, Other information, previously included a number of .

-Her Form 1065 K-1 shows a distribution in Box 19 Code A only.-I think I finally manage to get TurboTax to treat it as capital gains by selecting "Stocks, Mutual Funds, Bonds, Other" -> Other and reporting as a Investment Sales with 0 basis. I had to play around with the acquired date so that it was more than 1 year before the actual .

Box 19. Distributions. For 2023, partners receiving distributions of property from a partnership in a liquidating or non-liquidating distribution under certain circumstances must attach a statement to their tax return. See Box 19. Distributions, later. Box 20. Other information. Code AH, Other information, previously included a number of .Box 19. Distributions. For 2023, partners receiving distributions of property from a partnership in a liquidating or non-liquidating distribution under certain circumstances must attach a statement to their tax return. See Box 19. Distributions, later. Box 20. Other information. Code AH, Other information, previously included a number of . Where are distributions reported on k1? Box 19 of the K-1 (1065) records distributions made to you, the partner or member, during the year. How is k1 passive income taxed? Is passive income taxable? Yes, the IRS does collect taxes on passive income.

Where are distributions reported on k1? Box 19 of the K-1 (1065) records distributions made to you, the partner or member, during the year. How is k1 passive income taxed? Is passive income taxable? Yes, the IRS does .Box 19. Distributions. For 2023, partners receiving distributions of property from a partnership in a liquidating or non-liquidating distribution under certain circumstances must attach a statement to their tax return. See Box 19. Distributions, later. Box 20. Other information. Code AH, Other information, previously included a number of .

Cash distributions are reported on the 1065 Sch K line 19(a) and on each partner's K-1 box 19 Code A in proportion to the ownership. They will also be reported in two other places depending on how you respond to form 1065 Sch B question. If the answer to this question is "No", then they will also be reflected on Sch M-2 line 6(a) and also on .

menards galvanized sheet metal

Why doesn't the value I enter in box 19 on schedule K-1 affect the calculations in my Federal Tax return? I would expect a cash distribution from LLC should increase taxable income (i.e. capital gains).Those distributions should be reported in box 19 of the K-1. They should also show up in Box L Partner's Capital Account Analysis on the line that says Withdrawals and distributions. . The only other box my K-1 has any information in is box 20 - codes N and Z. I *think* I entered this information into TurboTax correctly, but it shows a Box 19. Distributions...25 Box 20. Other Information...26 List of Codes...32 Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Schedule K . .

In 2011, the K-1 reflects a box 19C distribution of close to half a million dollars. According to the preparer (CPA) of the 1065 and K-1, this distribution was "an adjustment between 3 companies for stockholder debt" and he "sees .

If there's a distribution in excess of basis, Lacerte doesn't automatically compute the gain. . Complete the Computation of Section 737 Gain worksheet provided in the partner's instructions for Schedule K-1. The gain from the worksheet must be entered in Screen 17.1, Dispositions. . Entering partnership Schedule K-1, Box 19B in ProConnect Tax.Schedule K-1 (Form 1120-S) and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form1120S. General Instructions Purpose of Schedule K-1 The corporation uses Schedule K-1 to report your share of the corporation's income, deductions, credits, and other items. Keep it for your records. Don't file it with your tax How are K-1 distributions taxed? For general partners in a pass-through business, income distributed from the company is typically considered earned income, and the partner will owe income tax and self-employment taxes (both the employee and employer contributions to Social Security and Medicare) on the distribution. Since the partnership has .

Box 19. Distributions...25 Box 20. Other Information...26 List of Codes...32 Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Schedule K .Box 19. Distributions . Box 20. Other Information . List of Codes. List of Codes and References Used in Schedule K-1 \(Form 1065\) List of Codes and References Used in Schedule K-1 \(Form 1065\) Page 2 of 22.Box 19. Distributions ...15 Box 20. Other Information ...16 List of Codes ...21 Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Schedule K-1 (Form 1065) and the Partner's Instructions for Schedule K-1 (Form 1065), such as

What are the types of metal forming processes? Bending; Stretching; Deep Drawing; Roll Forming; Extrusion; Punching; Stamping; Ironing; Hydroforming; Metal forming is a part of the metal fabrication process and is used to create structural parts or complex pieces out of metal sheets and tubing. It’s an essential procedure for a wide variety .

k-1 box 19 distributions a|statement a schedule k 1