form 1099 r box 7 distribution code 7d May 18, 2023 7:46 AM TurboTax is here to make the tax filing process as easy as . Twisted Metal Fabrication located at 185 Grand Ave, Fallon, NV 89406 - reviews, ratings, hours, phone number, directions, and more.

0 · irs distribution code 7 meaning

1 · irs code 7d on 1099

2 · irs 1099 box 7 codes

3 · form 1099 r box 7

4 · distribution code 7 normal

5 · 1099 r distribution code meanings

6 · 1099 r code 7 taxable

7 · 1099 form distribution code 7

The junction box concept is based on a flexible, open system structure, which allows serial as well as parallel interconnection via direct wire connect or separable connectors. Within the junc tion box, up to six termination places rails are available for photovoltaic foil connection. If required by the customer, the junction box can be delivered

Box 7 is used to report income to you. The different codes within box 7 tell what the tax treatment of any distribution amounts should be. 7 is the code for Normal Distribution (which means it was distributed to taxpayer after age 59.5). D is the new 'nonqualified annuity .Box 7 is used to report income to you. The different codes within box 7 tell what the .May 18, 2023 7:46 AM TurboTax is here to make the tax filing process as easy as .About form 1099-NEC; Crypto taxes; About form 1099-K; Small business taxes; .

irs distribution code 7 meaning

irs code 7d on 1099

We would like to show you a description here but the site won’t allow us.If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .

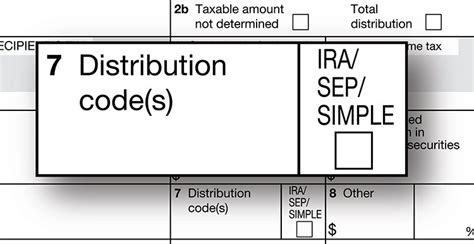

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution .

Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, exempt from penalties, or rolled over into another . L (Deemed Distribution from Loan) P (Taxable in prior year of the 1099-R year—the year the refunded contribution was made) Code 7: Normal distribution. The distribution is after . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code (s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, . The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form . I received a 1099R with Box 7 containing codes D7. On source screen do I select "qualified IRA" or "None of the Above"? Also noted that when reviewing the screen, "None of the Above" is changed to " distribution before retirement". Is this normal? Review was made by going through update process, not using Back key. One of the most difficult aspects of reporting IRA and QRP distributions is determining the proper distribution code(s) to enter in Box 7, Distribution code(s) on IRS Form 1099-R, Distributions From Pensions, .

Form 1099-R Box 7 Distribution Codes (continued) Box 7 Distribution Codes Explanations A — May be eligible for 10-year tax option This code is Out of Scope. B — Designated Roth account distribution Code B is for a distribution from a designated Roth account. This code is in scope only if taxable amount has been determined. D — Annuity . Usually, you should see a code 7 in box 7 on your Form 1099-R. If the distribution is for your RMD for the year, it will be treated as a normal distribution. The code 7 will be marked in Box 7 on your Form 1099-R. Besides, it will also be reported on a Form 5498 "IRA Contribution Information" where box 11 and 12 will be checked .You are not .Form 1099-R reports the total retirement and pension benefits you received during the year. Please refer to box 7 on Form(s) 1099-R for the distribution code(s) that describes the condition under which the retirement or pension benefit was paid.

irs 1099 box 7 codes

A Form 1099-R without a code in box 7 is not valid. If you are over age 59½, are you sure that box 7 does not have code 7? It's not uncommon for people to miss seeing a code 7 since it is the same as the box number. . If it was a regular distribution, go ahead and put code 7 in box 7. As dmertz points out, a 1099-R without a code in box 7 is .

I received a 1099-R with Box 7 coded as 4D which is correct it is for an Inherited Annuity Total Distribution. In Federal it asks Where is this Distribution . but TurboTax doesn't like the Source Code of Distribution of "None of the above" . About form 1099-NEC; Crypto taxes; About form 1099-K; Small business taxes; Amended tax return; wrote: The 2020 1099-R Block 7does not have a 2nd drop down block. There is only one block and the 7D is there. On turbo tax 2020, the 2nd line down has different codes. D is for Death. The D in block 7 on the 1099 now is for disability, which applies to me but the block on Turbo Tax will on.

Her 1099R has box 1 gross distribution 27,000 box 2 7,000, box 5 34,000 box 7 code 7D. Taxable amount not determined not mark and total distribution not marked. . The IRS instructions for Form 1099-R state, for Code "D", the following: . The 1099 code D (box 7) is correct in that there is 00.00 of investment income which may or may not .

You use code 7 - Normal Distribution in box 7. There is not such code for 7 - Nondisability. That is something that OPM enters on the 1099-R and does not comply with the IRS approved codes for box 7. . Nondisability you enter a code 7 in box 7 of the TurboTax form 1099-R. April 4, 2020 12:02 PM. 0 3,750 Reply. Bookmark Icon. washby . Each code represents a different description. Both codes can be entered into TurboTax when you are completing the Form 1099-R information. When you get to box 7, first use code 7 and in the next box select code D. They are entered individually and not together in one slot. What do all the codes mean in box 7 of Form 1099-R? 7 – Normal .The Distribution Code, which is box 7 on the 1099-R, further identifies the reason for the withdrawal. shows distribution code 1 in Box 7. However, use Code 1 even if the distribution is made for medical . Generally, if you are under age 59 1/2, you must pay a 10% additional tax on the distribution of any assets (money or other property) from your traditional IRA.Tags:Irs Form .I received a form 1099-R with 7D distribution code but there is no amount in the "taxable amount" box. Do i owe any . I have 1099 R’s that have PA tax withheld but nothing in the State distribution box. Then I have one that has PA. Rick. Rick, CPA. 75,062 Satisfied Customers.

You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, which is the distribution code(s) box of your Form 1099-R. Who completes Form 1099-R? It should not be marked IRA/SEP if the 1099-R box is not checked. I have a 1099-R Distribution Code 8. No IRA/SEP box is checked. This is not taxable income for Illinois. There is no section to exclude on the Illinois form. It continues to tax this income. How do you stop it from taxing on Illinois - I already pay enough to the state.Report the gross distribution in box 1 of Form 1099-R. In box 2a, enter the excess and earnings distributed less any after-tax contributions. . (Code 7), file one Form 1099-R for the part to which Code 1 applies and another Form 1099-R for the part to which Code 7 applies. In addition, for the distribution of excess deferrals, parts of the .A distribution code 2 isn't entered unless the 1099-R indicates a code 1 and a code 2. Even if the taxpayer has two 1099-R from the same payer, they are each entered separately with a distribution code 1 for each 1099-R. Use code 2 only if the employee/taxpayer hasn't reached age 59 & 1/2 and you know the distribution is:

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R. [NOTE: When you get to the "Your 1099-R Entries" screen where you can add another 1099-R, use "continue" to keep going as there are additional interview questions after that screen in most cases. You can always return as shown above.] If my 1099-R for roth annuity, box 7 shows 7D what should I show on the tax return? Topics: TurboTax Premier Online; posted March 30, 2020 11:02 . There are 2 places for the codes, enter them both. Enter 7 in the first section and D in the second selection. . About form 1099-NEC; Crypto taxes; About form 1099-K; Small business taxes; The box 7 code was "J". . penalty on a 2021 Form 5329. The code-J distribution in 2022 corrects this excess and will reduce the ,000 excess carried into 2022 from 2021 to zero on the 2022 Form 5329. 2) Yes, codes J and P are correct for the return of the excess contribution for 2021. . the 2022 Form 1099-R with codes P and J for the . Code 12 Exceptions • Distribution on or after the date the participant turned age 59½ if box 7, Form 1099-R, incorrectly indicates it is an early distribution with codes 1, J, or S. [IRC §72(t)(2)(A)(i)] Contact form 1099-R issuer to ask .

If there is no code or number there, you should contact the Payor to get a corrected 1099-R. Here's some info about the codes in Box 7: The code(s) in Box 7 of your 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions, to determine if your distribution is taxable or subject .Form . 1099-R. 2024. Cat. No. 14436Q. Distributions From Pensions, Annuities, Retirement or . 7 . Distribution code(s) IRA/ SEP/ SIMPLE. 8 . Other $ % 9a . Your percentage of total distribution % . If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable

When you receive a Form 1099-R for a retirement or pension distribution, you’ll notice that Box 7 contains a distribution code. These distribution codes are essential for understanding how your distribution will be taxed and if there are any additional penalties. Let’s break down these codes to help you understand what each one means and how it impacts .pension benefits from the same Payer FEIN and distribution code, combine those amounts on the same line. Line 7D: List the distribution code from box 7 of the federal Form 1099-R. Line 7F: Include the taxable amount of retirement or pension reported in federal AGI. If you are a part-year resident only use

The distribution code is 7D February 21, 2020 9:57 AM. 0 1 37,274 Bookmark Icon. dmertz. Level 15 Mark as New; Bookmark; Subscribe; Subscribe to RSS Feed; Permalink; . TurboTax's 1099-R form has two box 7 drop-downs. Select "7" in one and "D" in the other. February 21, 2020 11:32 AM. 0 3 37,259 Bookmark Icon. Tethy-_1930. Level 2 Mark .

Enter the Form 1099-R as received. The follow up questions will ask what you did with money. Answer where indicated You moved the money to another retirement account (or returned it to the same retirement account). See Screenshot. To enter a form 1099-R -

$149.99

form 1099 r box 7 distribution code 7d|irs code 7d on 1099