cnc machine depreciation rate Jul 1, 2009

SockitBox – The Original Weatherproof Connection Box – Indoor & Outdoor Electrical Power Cord Enclosure for Timers, Extension Cables, Transformers, Power Strips, Lights, Tools & More – Medium – Black

0 · standard depreciation rate for equipment

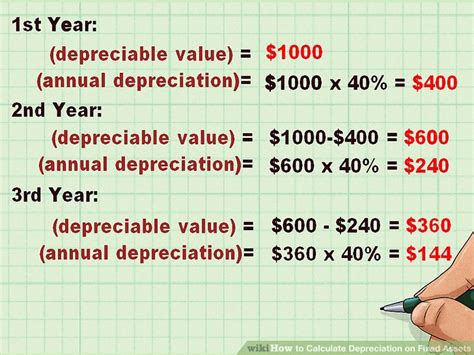

1 · how to compute depreciation value

2 · how to compute depreciation cost

3 · how to calculate useful life

4 · fixed assets useful life

5 · estimated useful life of assets

6 · changing useful life of assets

7 · calculating depreciation on equipment

SockitBox – The Original Weatherproof Connection Box – Indoor & Outdoor Electrical Power Cord Enclosure for Timers, Extension Cables, Holiday Lights, Power Tools, Fountains & More – .

Straight-line depreciation is the simplest and most common method for calculating CNC machine depreciation. This method involves dividing the cost of the machine by its useful life and subtracting the same amount each year until the asset is fully depreciated.

electrical pvc junction box

In this blog post, we will delve into the various factors that influence CNC .Employing accurate depreciation rates helps firms better manage their CNC .In this blog post, we will delve into the various factors that influence CNC machine depreciation rates and provide valuable insights for effectively managing this aspect of your manufacturing business.

standard depreciation rate for equipment

Employing accurate depreciation rates helps firms better manage their CNC machines,determine their resale values,keep tabs on total manufacturing costs,and guide future purchases. In citing a CNC machine's depreciation rate,the 'Straight Line Depreciation Method' is usually in play. Jul 1, 2009

This illustration shows how the regulation of Section 179 can greatly reduce the actual cost of your CNC machine acquisition. Bonus Depreciation in 2024. In addition to Section 179, bonus depreciation is 60% for 2024. There is more tax savings for larger equipment investments after spending reaches the Section 179 spending cap.Under extended Section 179 limits established by the Protecting Americans from Tax Hikes Act of 2015, businesses are allowed to purchase qualifying equipment to immediately depreciate new or used equipment costs. Using this information, the hourly rate of depreciation of the machine can be calculated by applying the following formula: Hourly rate of depreciation = (Original cost of machine — Estimated scrap value) / Effective . First-year standard depreciation on a machine tool is often 14.29 percent. The depreciation is applied in the order above to determine the total tax savings.

how to compute depreciation value

how to compute depreciation cost

View operating history and production rates in visual graph format and see alarm history with live links to alarm details, all on an easy-to-read display. Send us another company’s quote on your horizontal or vertical machining center's .

Straight-line depreciation is the simplest and most common method for calculating CNC machine depreciation. This method involves dividing the cost of the machine by its useful life and subtracting the same amount each year until the asset is fully depreciated.

In this blog post, we will delve into the various factors that influence CNC machine depreciation rates and provide valuable insights for effectively managing this aspect of your manufacturing business.

Employing accurate depreciation rates helps firms better manage their CNC machines,determine their resale values,keep tabs on total manufacturing costs,and guide future purchases. In citing a CNC machine's depreciation rate,the 'Straight Line Depreciation Method' is usually in play. ATO Depreciation Rates 2023 . Computer numerical control (CNC) machines (including CNC routers) 10 years: 20.00%: 10.00%: 1 Jul 2022: Upholstery assets: . Prime Cost Rate Date of Application; Machine tools (grinding machines, lathes, milling machines etc): CNC and NC based machines: In the first year, the value of the CNC machine would depreciate by ,000. In the second year, the depreciation will be 13.5% of the current book value of 3,000, which turns out into ,350. Using the formula, here is a quick chart of depreciation for the following years: This illustration shows how the regulation of Section 179 can greatly reduce the actual cost of your CNC machine acquisition. Bonus Depreciation in 2024. In addition to Section 179, bonus depreciation is 60% for 2024. There is more tax savings for larger equipment investments after spending reaches the Section 179 spending cap.

Under extended Section 179 limits established by the Protecting Americans from Tax Hikes Act of 2015, businesses are allowed to purchase qualifying equipment to immediately depreciate new or used equipment costs. Using this information, the hourly rate of depreciation of the machine can be calculated by applying the following formula: Hourly rate of depreciation = (Original cost of machine — Estimated scrap value) / Effective working life of machine in terms of running hours. (b) Repairs and Maintenance.

First-year standard depreciation on a machine tool is often 14.29 percent. The depreciation is applied in the order above to determine the total tax savings.View operating history and production rates in visual graph format and see alarm history with live links to alarm details, all on an easy-to-read display. Send us another company’s quote on your horizontal or vertical machining center's spindle cartridge repair - if we can’t be competitive, we’ll give you a VISA gift card.

Straight-line depreciation is the simplest and most common method for calculating CNC machine depreciation. This method involves dividing the cost of the machine by its useful life and subtracting the same amount each year until the asset is fully depreciated.In this blog post, we will delve into the various factors that influence CNC machine depreciation rates and provide valuable insights for effectively managing this aspect of your manufacturing business.Employing accurate depreciation rates helps firms better manage their CNC machines,determine their resale values,keep tabs on total manufacturing costs,and guide future purchases. In citing a CNC machine's depreciation rate,the 'Straight Line Depreciation Method' is usually in play.

ATO Depreciation Rates 2023 . Computer numerical control (CNC) machines (including CNC routers) 10 years: 20.00%: 10.00%: 1 Jul 2022: Upholstery assets: . Prime Cost Rate Date of Application; Machine tools (grinding machines, lathes, milling machines etc): CNC and NC based machines:

how to calculate useful life

In the first year, the value of the CNC machine would depreciate by ,000. In the second year, the depreciation will be 13.5% of the current book value of 3,000, which turns out into ,350. Using the formula, here is a quick chart of depreciation for the following years: This illustration shows how the regulation of Section 179 can greatly reduce the actual cost of your CNC machine acquisition. Bonus Depreciation in 2024. In addition to Section 179, bonus depreciation is 60% for 2024. There is more tax savings for larger equipment investments after spending reaches the Section 179 spending cap.Under extended Section 179 limits established by the Protecting Americans from Tax Hikes Act of 2015, businesses are allowed to purchase qualifying equipment to immediately depreciate new or used equipment costs. Using this information, the hourly rate of depreciation of the machine can be calculated by applying the following formula: Hourly rate of depreciation = (Original cost of machine — Estimated scrap value) / Effective working life of machine in terms of running hours. (b) Repairs and Maintenance.

First-year standard depreciation on a machine tool is often 14.29 percent. The depreciation is applied in the order above to determine the total tax savings.

fixed assets useful life

$9.89

cnc machine depreciation rate|fixed assets useful life