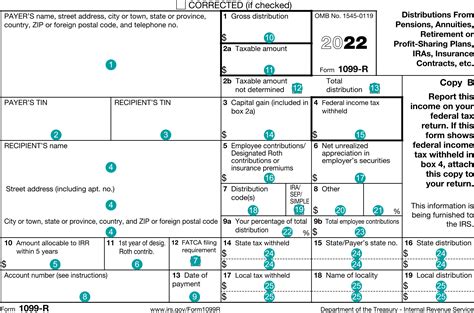

distribution code 2 box 7 One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply . $361.95

0 · pension distribution codes

1 · irs roth distribution codes

2 · irs pension distribution codes

3 · ira normal distribution 7

4 · box 7 code 4

5 · box 7 1099 r

6 · 1099 r 7d distribution code

7 · 1099 box 7 code 6

Check out our metal and wood box selection for the very best in unique or custom, handmade pieces from our boxes & bins shops.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 2. Early distribution, exception applies. Use Code 2 only if the participant has not . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .

fabrication of sheet metal factories

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not .For a Roth IRA conversion, use Code 2 in box 7 if the participant is under age 59½ or Code 7 if the participant is at least age 59½. Also, check the IRA/SEP/SIMPLE checkbox in box 7.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, . The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498 Instructions on how to enter Form .

Code 2: Early Distribution, Exception Applies. Code 2 is used when an early distribution is taken from a retirement plan or IRA, but an exception to the 10% early withdrawal penalty applies. Code 3: Disability. This code is . This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Code 7: Normal .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.2. Early distribution, exception applies. Use Code 2 only if the participant has not reached age 59 1/2 and you know the distribution is: A Roth IRA conversion (an IRA converted to a Roth IRA). A distribution made from a qualified retirement plan or IRA because of . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and

For a Roth IRA conversion, use Code 2 in box 7 if the participant is under age 59½ or Code 7 if the participant is at least age 59½. Also, check the IRA/SEP/SIMPLE checkbox in box 7.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498 Instructions on how to enter Form 1099-R on your tax return Code 2: Early Distribution, Exception Applies. Code 2 is used when an early distribution is taken from a retirement plan or IRA, but an exception to the 10% early withdrawal penalty applies. Code 3: Disability. This code is used to indicate a distribution from a retirement account due to the account owner's total and permanent disability. This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Code 7: Normal distribution. The distribution is after age 59 1/2. B (Designated .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.2. Early distribution, exception applies. Use Code 2 only if the participant has not reached age 59 1/2 and you know the distribution is: A Roth IRA conversion (an IRA converted to a Roth IRA). A distribution made from a qualified retirement plan or IRA because of . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding andFor a Roth IRA conversion, use Code 2 in box 7 if the participant is under age 59½ or Code 7 if the participant is at least age 59½. Also, check the IRA/SEP/SIMPLE checkbox in box 7.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498 Instructions on how to enter Form 1099-R on your tax return Code 2: Early Distribution, Exception Applies. Code 2 is used when an early distribution is taken from a retirement plan or IRA, but an exception to the 10% early withdrawal penalty applies. Code 3: Disability. This code is used to indicate a distribution from a retirement account due to the account owner's total and permanent disability.

pension distribution codes

$49.99

distribution code 2 box 7|irs pension distribution codes