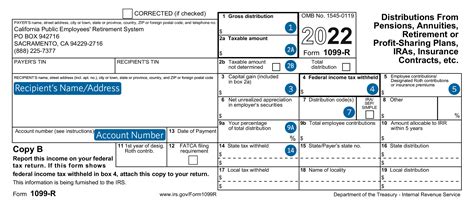

1099 r distribution box 5 employee contributions My after tax contributions are reported in Box 5 of Form 1099-R. (Employee contributions/designated Roth contributions or insurance premiums). But Box 9b (Total employee contributions) reports zero. It appears that I am now being taxed on these funds which are . Custom Welding, Metal Fabrication, Electroplating, Drafting, Polishing and Powder Coating. Take the time to stop in at Valley Metal Ltd. and be greeted with a firm handshake, a fair estimate and a project that is delivered on time and on budget.

0 · total employee contributions 1099 r

1 · is 1099 r taxable

2 · gross distribution on 1099 r

3 · form 1099 r worksheet

4 · 1099 r taxable amount

5 · 1099 r income taxable

6 · 1099 r boxes explained

7 · 1099 r box 5 instructions

VAULT ® lighting solutions typically start around $2000, and then rise accordingly .

My after tax contributions are reported in Box 5 of Form 1099-R. (Employee contributions/designated Roth contributions or insurance premiums). But Box 9b (Total employee contributions) reports zero. It appears that I am now being taxed on these funds which are .

My after tax contributions are reported in Box 5 of Form 1099-R. (Employee .Employee Tax Expert. Join the Community. Resources. File your own taxes. From .TurboTax is here to make the tax filing process as easy as possible. We're .We would like to show you a description here but the site won’t allow us.

Box 5. Employee Contributions/Designated Roth Account Contributions or Insurance Premiums. Enter the employee's contributions, designated Roth account contributions, or insurance .

total employee contributions 1099 r

is 1099 r taxable

Box 5 - Employee contributions / Designated Roth contributions or insurance premiums generally shows the taxpayer's investment in the contract (after-tax contributions), if any, recovered tax free this year. The 1099-R from OPM, box 5 is after-tax dollars (excluded from box 1). If you can determine the portion that belongs to medical expenses, they are deductible. The same is true . Box 5 on an IRS Form 1099-R is not a tax. Box 5. Generally, this shows the employee’s investment in the contract (after-tax contributions), if any, recovered tax free this .Box 5: Employee contributions / Designated Roth contributions or insurance premiums. Compared to Box 2a, which shows the taxable amount of your employee’s distribution, this section .

is not taxable is shown in Box 5 of the 1099-R. It is this amount that the IRS considers . return of your previously taxed contributions. If you subtract the amount in Box 2a (Taxable amount) .File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. .2a- Taxable amounts – If you’re trying to figure out if you have to pay taxes on a 1099-R distribution, this is where you’ll want to look. 2b- Taxable amount not determined and total distribution; 3- Capital gain; 4- Federal income tax .

Box 7: Distribution code(s) — This box has a code indicating the type of distribution, such as early withdrawal, normal distribution, or a Roth distribution. For a . My after tax contributions are reported in Box 5 of Form 1099-R. (Employee contributions/designated Roth contributions or insurance premiums). But Box 9b (Total .

gross distribution on 1099 r

Box 5. Employee Contributions/Designated Roth Account Contributions or Insurance Premiums. Enter the employee's contributions, designated Roth account contributions, or insurance premiums that the employee may recover tax free this year (even if . Box 5 - Employee contributions / Designated Roth contributions or insurance premiums generally shows the taxpayer's investment in the contract (after-tax contributions), if any, recovered tax free this year.

The 1099-R from OPM, box 5 is after-tax dollars (excluded from box 1). If you can determine the portion that belongs to medical expenses, they are deductible. The same is true with FEHB, any post tax dollars count for medical expenses. Box 5 on an IRS Form 1099-R is not a tax. Box 5. Generally, this shows the employee’s investment in the contract (after-tax contributions), if any, recovered tax free this year; the portion that’s your basis in a designated Roth account; the part of.Box 5: Employee contributions / Designated Roth contributions or insurance premiums. Compared to Box 2a, which shows the taxable amount of your employee’s distribution, this section indicates what portion of their plan contribution, designated Roth contribution, or .is not taxable is shown in Box 5 of the 1099-R. It is this amount that the IRS considers . return of your previously taxed contributions. If you subtract the amount in Box 2a (Taxable amount) from the amount in Box 1 (Gross distribution), you will end up with the amount shown in .

utah sheet metal

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Annuities, pensions, insurance contracts, survivor income benefit plans.2a- Taxable amounts – If you’re trying to figure out if you have to pay taxes on a 1099-R distribution, this is where you’ll want to look. 2b- Taxable amount not determined and total distribution; 3- Capital gain; 4- Federal income tax withheld; 5- Employee contributions/Designated ROTH contributions or insurance premiums Box 7: Distribution code(s) — This box has a code indicating the type of distribution, such as early withdrawal, normal distribution, or a Roth distribution. For a complete list of codes and their meanings, see Table 1 in the IRS Instructions for Forms 1099-R and 5498 . My after tax contributions are reported in Box 5 of Form 1099-R. (Employee contributions/designated Roth contributions or insurance premiums). But Box 9b (Total .

Box 5. Employee Contributions/Designated Roth Account Contributions or Insurance Premiums. Enter the employee's contributions, designated Roth account contributions, or insurance premiums that the employee may recover tax free this year (even if . Box 5 - Employee contributions / Designated Roth contributions or insurance premiums generally shows the taxpayer's investment in the contract (after-tax contributions), if any, recovered tax free this year. The 1099-R from OPM, box 5 is after-tax dollars (excluded from box 1). If you can determine the portion that belongs to medical expenses, they are deductible. The same is true with FEHB, any post tax dollars count for medical expenses.

Box 5 on an IRS Form 1099-R is not a tax. Box 5. Generally, this shows the employee’s investment in the contract (after-tax contributions), if any, recovered tax free this year; the portion that’s your basis in a designated Roth account; the part of.Box 5: Employee contributions / Designated Roth contributions or insurance premiums. Compared to Box 2a, which shows the taxable amount of your employee’s distribution, this section indicates what portion of their plan contribution, designated Roth contribution, or .

is not taxable is shown in Box 5 of the 1099-R. It is this amount that the IRS considers . return of your previously taxed contributions. If you subtract the amount in Box 2a (Taxable amount) from the amount in Box 1 (Gross distribution), you will end up with the amount shown in .File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Annuities, pensions, insurance contracts, survivor income benefit plans.2a- Taxable amounts – If you’re trying to figure out if you have to pay taxes on a 1099-R distribution, this is where you’ll want to look. 2b- Taxable amount not determined and total distribution; 3- Capital gain; 4- Federal income tax withheld; 5- Employee contributions/Designated ROTH contributions or insurance premiums

form 1099 r worksheet

Preserving bins are indeed pretty useful as generic storage. You can also overlap smithy quite efficiently and they do 75 items on vanilla.

1099 r distribution box 5 employee contributions|1099 r income taxable