box 16 state distribution We would like to show you a description here but the site won’t allow us. I am trying to design a solution for providing a dropped receptacle mounted in a junction box around 6' above the finished floor. It would be fed from a conduit that goes up to a 13 ft. ceiling into a j-box surface mounted to the ceiling.

0 · taxable amount not determined

1 · irs form for pension income

2 · form 1099 r box 2a

3 · 1099 r taxable amount

4 · 1099 r is for what

5 · 1099 r boxes explained

6 · 1099 r box 8

7 · 1099 r box 16 blank

3M™ Unitek™ Gemini Brackets offer a system designed to optimize orthodontic .

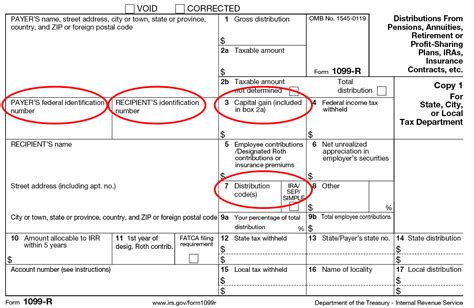

If your Form 1099-R does not have an amount in box 16 for a state distribution, but there is an amount in box 14 for state tax withheld, then the review message thinks there should be something in box 16.

If your Form 1099-R does not have an amount in box 16 for a state distribution, .TurboTax is here to make the tax filing process as easy as possible. We're .Install or update products Tax filing status State topics Choose products. Income. .We would like to show you a description here but the site won’t allow us.

If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State .In boxes 16 and 19, you may enter the amount of the state or local distribution. Copy 1 may be used to provide information to the state or local tax department. Copy 2 may be used as the .

For distributions from a Roth IRA, generally the payer isn’t required to compute the taxable amount. You must compute any taxable amount on Form 8606. An amount shown in box 2a . The payer populates their state identification number here (you should have a value here if you have an amount in Box 14 on your 1099-R). Box 16. This box shows the .

Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding.

If Minnesota state income tax was withheld from your benefit payments, this box shows the amount submitted to the Minnesota Department of Revenue to cover your Minnesota tax . You must file Form 1099-R with the IRS if you have given away or are treated as having made a distribution of or more from any of the following: Pensions. Annuities. Charitable gift annuities. Survivor income benefit plans. . Since retirement income follows residency, you'll need to apply the law for the client's state of residency. And you'll have to determine if it qualifies as a disability retirement .

Box 16 reveals the state distribution on the 1099-R, while Box 14 indicates the state tax amount withheld. Important to note is that it is the taxpayer's, or preparer's, responsibility to determine the taxable amount for .If your Form 1099-R does not have an amount in box 16 for a state distribution, but there is an amount in box 14 for state tax withheld, then the review message thinks there should be something in box 16. If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State .In boxes 16 and 19, you may enter the amount of the state or local distribution. Copy 1 may be used to provide information to the state or local tax department. Copy 2 may be used as the recipient's copy in filing a state or local income tax return.

For distributions from a Roth IRA, generally the payer isn’t required to compute the taxable amount. You must compute any taxable amount on Form 8606. An amount shown in box 2a may be taxable earnings on an excess contribution. Loans treated as distributions. The payer populates their state identification number here (you should have a value here if you have an amount in Box 14 on your 1099-R). Box 16. This box shows the amount of your state distribution (you should have a value in .Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding.If Minnesota state income tax was withheld from your benefit payments, this box shows the amount submitted to the Minnesota Department of Revenue to cover your Minnesota tax liability. Include the amount on your Minnesota income tax return as tax withheld.

You must file Form 1099-R with the IRS if you have given away or are treated as having made a distribution of or more from any of the following: Pensions. Annuities. Charitable gift annuities. Survivor income benefit plans. Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Since retirement income follows residency, you'll need to apply the law for the client's state of residency. And you'll have to determine if it qualifies as a disability retirement by asking your client some questions about their circumstances.

Box 16 reveals the state distribution on the 1099-R, while Box 14 indicates the state tax amount withheld. Important to note is that it is the taxpayer's, or preparer's, responsibility to determine the taxable amount for the year's total distribution.If your Form 1099-R does not have an amount in box 16 for a state distribution, but there is an amount in box 14 for state tax withheld, then the review message thinks there should be something in box 16. If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State .In boxes 16 and 19, you may enter the amount of the state or local distribution. Copy 1 may be used to provide information to the state or local tax department. Copy 2 may be used as the recipient's copy in filing a state or local income tax return.

For distributions from a Roth IRA, generally the payer isn’t required to compute the taxable amount. You must compute any taxable amount on Form 8606. An amount shown in box 2a may be taxable earnings on an excess contribution. Loans treated as distributions.

taxable amount not determined

The payer populates their state identification number here (you should have a value here if you have an amount in Box 14 on your 1099-R). Box 16. This box shows the amount of your state distribution (you should have a value in .Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding.

If Minnesota state income tax was withheld from your benefit payments, this box shows the amount submitted to the Minnesota Department of Revenue to cover your Minnesota tax liability. Include the amount on your Minnesota income tax return as tax withheld. You must file Form 1099-R with the IRS if you have given away or are treated as having made a distribution of or more from any of the following: Pensions. Annuities. Charitable gift annuities. Survivor income benefit plans. Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Since retirement income follows residency, you'll need to apply the law for the client's state of residency. And you'll have to determine if it qualifies as a disability retirement by asking your client some questions about their circumstances.

best cnc machines for cabinet making

Find Metal Wall Art at Wayfair. Enjoy Free Shipping & browse our great selection of Wall Art & Coverings, All Wall Art, Canvas Art and more!

box 16 state distribution|1099 r is for what