are 409a distributions reported on w2 box 16 For employees, these amounts should be included in box 1 of the Form W-2s as wages, reported in box 12 of the Form W-2s as Section 409A income using code Z, and . $249K+

0 · W

1 · Reporting and Wage Withholding under Section 409A

2 · Operating nonqualified deferred compensation plans

3 · OVERVIEW OF DEFERRED COMPENSATION

4 · Nonqualified deferred compensation plan FAQs for

5 · Nonqualified Deferred CompensationAudit Technique Guide

6 · How is a deferred compensation plan (under section 409A of the

7 · Common mistakes in nonqualified deferred

8 · 10.10 Summary of IRC Section 409A – Nonqualified deferred

In one of their first acts in power, House Republicans removed the metal detectors outside the House chamber, just days before the second anniversary of the Jan. 6 Capitol attacks. Former.

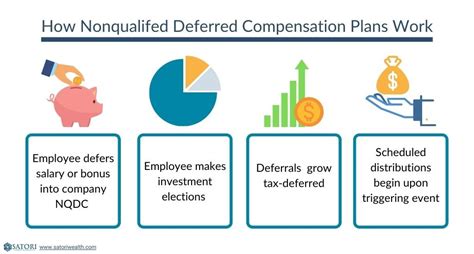

In a properly designed plan in compliance with the section 409A rules, the promised amount becomes includable in the employee’s taxable income as the amount is paid (or becomes available) to the employee. Like other . Upon the employee’s receipt of the payment in a later year, the NQDC is subject to federal income tax and is reportable on an employee’s Form W-2 in boxes 1 (Wages, tips, other compensation), 2 (Federal income tax . To curtail this abuse, Sec. 409A places restrictions on the deferral of compensation under nonqualified deferred compensation plans (including underlying agreements or any other arrangement providing nonqualified .IRC § 409A(a) addresses the design and operation of deferred compensation arrangements, while IRC § 409A(b) contains restrictions on deferred compensation funding.

For employees, these amounts should be included in box 1 of the Form W-2s as wages, reported in box 12 of the Form W-2s as Section 409A income using code Z, and . Distributions to employees from nonqualified deferred compensation plans are considered wages subject to income tax upon distribution. Since nonqualified distributions are .Employer Reporting and Wage Withholding Provisions. Annual Deferrals -- Amounts Reportable on Form W-2 or Form 1099-MISC. For employers, code Y reporting in box 12 of Form W-2 is . 409A creates a new regulatory landscape that focuses on 3 major areas: 1. Which arrangements are considered “deferred compensation” subject to the new rules; 2. Rules .

IRC Section 409A determines when an employee is taxed for deferred compensation, including most types of stock-based compensation awards (see SC 10.2.5, SC 10.6.3, SC 10.6.4, and . NQDC plans are sometimes called 409 (a) plans after the section of the U.S. Tax Code that regulates them. The Social Security and Medicare tax (FICA on your W-2) is paid on compensation when it.In a properly designed plan in compliance with the section 409A rules, the promised amount becomes includable in the employee’s taxable income as the amount is paid (or becomes available) to the employee. Like other compensation, employers report the distributed amount as taxable compensation.

Upon the employee’s receipt of the payment in a later year, the NQDC is subject to federal income tax and is reportable on an employee’s Form W-2 in boxes 1 (Wages, tips, other compensation), 2 (Federal income tax withheld) and 11 (Nonqualified plans). To curtail this abuse, Sec. 409A places restrictions on the deferral of compensation under nonqualified deferred compensation plans (including underlying agreements or any other arrangement providing nonqualified deferrals), subject to some exceptions and exclusions.IRC § 409A(a) addresses the design and operation of deferred compensation arrangements, while IRC § 409A(b) contains restrictions on deferred compensation funding.

For employees, these amounts should be included in box 1 of the Form W-2s as wages, reported in box 12 of the Form W-2s as Section 409A income using code Z, and treated as supplemental wages for income tax withholding. Distributions to employees from nonqualified deferred compensation plans are considered wages subject to income tax upon distribution. Since nonqualified distributions are subject to income taxes, these amounts should be included in amounts reported on Form W-2 in Box 1, Wages, Tips, and Other Compensation.Employer Reporting and Wage Withholding Provisions. Annual Deferrals -- Amounts Reportable on Form W-2 or Form 1099-MISC. For employers, code Y reporting in box 12 of Form W-2 is not required for 2008 or any future year until future notice. Likewise, a payer is not required to report deferred amounts in box 15a of Form 1099- MISC. 409A creates a new regulatory landscape that focuses on 3 major areas: 1. Which arrangements are considered “deferred compensation” subject to the new rules; 2. Rules governing elections to defer compensation; and 3. Distributions of deferred compensation benefits. E. What Is The Effect Of Failing To Comply With 409A? 1.

IRC Section 409A determines when an employee is taxed for deferred compensation, including most types of stock-based compensation awards (see SC 10.2.5, SC 10.6.3, SC 10.6.4, and SC 10.6.4.2). NQDC plans are sometimes called 409 (a) plans after the section of the U.S. Tax Code that regulates them. The Social Security and Medicare tax (FICA on your W-2) is paid on compensation when it.In a properly designed plan in compliance with the section 409A rules, the promised amount becomes includable in the employee’s taxable income as the amount is paid (or becomes available) to the employee. Like other compensation, employers report the distributed amount as taxable compensation. Upon the employee’s receipt of the payment in a later year, the NQDC is subject to federal income tax and is reportable on an employee’s Form W-2 in boxes 1 (Wages, tips, other compensation), 2 (Federal income tax withheld) and 11 (Nonqualified plans).

To curtail this abuse, Sec. 409A places restrictions on the deferral of compensation under nonqualified deferred compensation plans (including underlying agreements or any other arrangement providing nonqualified deferrals), subject to some exceptions and exclusions.

IRC § 409A(a) addresses the design and operation of deferred compensation arrangements, while IRC § 409A(b) contains restrictions on deferred compensation funding.

For employees, these amounts should be included in box 1 of the Form W-2s as wages, reported in box 12 of the Form W-2s as Section 409A income using code Z, and treated as supplemental wages for income tax withholding. Distributions to employees from nonqualified deferred compensation plans are considered wages subject to income tax upon distribution. Since nonqualified distributions are subject to income taxes, these amounts should be included in amounts reported on Form W-2 in Box 1, Wages, Tips, and Other Compensation.

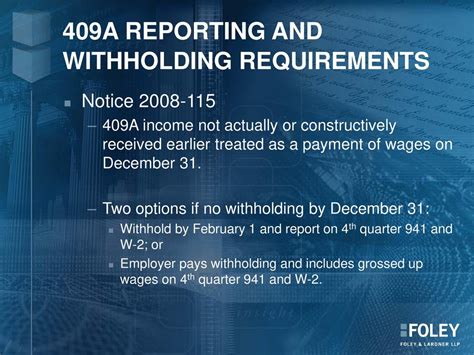

Employer Reporting and Wage Withholding Provisions. Annual Deferrals -- Amounts Reportable on Form W-2 or Form 1099-MISC. For employers, code Y reporting in box 12 of Form W-2 is not required for 2008 or any future year until future notice. Likewise, a payer is not required to report deferred amounts in box 15a of Form 1099- MISC. 409A creates a new regulatory landscape that focuses on 3 major areas: 1. Which arrangements are considered “deferred compensation” subject to the new rules; 2. Rules governing elections to defer compensation; and 3. Distributions of deferred compensation benefits. E. What Is The Effect Of Failing To Comply With 409A? 1.

black metal a frame house on stilts

Reporting and Wage Withholding under Section 409A

Steel Box Section Used Mezzanine Floor Post 100mm x 100mm Box Section 2605mm High With Top And Base Plate Ainscough Metals 18723. £162.00 £135.00+VAT InStock 18723 2024-12-15T04:32:01+00:00. View. 10.000 Mtr of 100 mm x 100 mm x 8 mm Steel Box Section ( Surplus )

are 409a distributions reported on w2 box 16|How is a deferred compensation plan (under section 409A of the